Introduction to Australia’s Economic Potential

In this discussion, we delve into Australia’s vast economic potential, a nation often described as having the resources and capacity to be among the wealthiest in the world. In this video, the guest, Leith Van Onselen, known for his unconventional economic insights, joins us in exploring this topic. The conversation will cover key themes such as Australia’s abundant resources, the complexities of its taxation system, and the challenges and opportunities in enhancing productivity.

“Australia should be the richest country.”

Australia’s Resource Wealth

Australia’s vast resource wealth positions it as a potential global economic leader. As highlighted by Matt Barry, a prominent Australian thinker and CEO of Freelancer.com, the country holds a significant share of the world’s essential resources.

“Australia basically controls or has a huge share of everything that the world needs at the moment.”

Overview of Australia’s Natural Resources

Australia is exceptionally rich in energy resources, excluding oil. It boasts abundant natural gas and coal reserves and is the largest exporter of iron ore globally. Additionally, Australia has substantial lithium deposits, which are crucial for the battery revolution, as well as nickel and uranium.

Global Significance

These resources are critical to global industries and technological advancements, underscoring Australia’s strategic importance on the world stage.

The Paradox of Resource Wealth

Despite its resource abundance, Australia faces economic challenges that prevent it from fully capitalizing on its potential to become one of the world’s wealthiest nations and a superpower.

Taxation and Economic Complexity

Australia’s taxation policies on its natural resources have been criticized for being inadequate. As noted, “We don’t tax any of this stuff properly,” highlighting a significant gap in the country’s economic strategy. This lack of proper taxation is compounded by the minimal value addition to these resources, resulting in an economy that is one of the most minor complex globally.

According to Harvard’s Economic Complexity Index, Australia ranks in the nineties, trailing behind many African nations. This low ranking is attributed to the country’s reliance on a simplistic economic model, primarily extracting and exporting raw materials. Additionally, the economy is bolstered by population growth through immigration rather than through enhancing productivity or economic complexity.

The Energy Crisis and Cost of Living

“We’ve managed to create an energy crisis and a cost of living crisis in this country.”

Australia is facing a significant energy crisis despite its vast natural resources. The country is the second-largest gas exporter globally and the largest coal exporter, yet it struggles with some of the world’s highest electricity and gas prices. This paradox has led to a severe cost of living crisis, impacting households and businesses.

The high energy costs have particularly affected Australia’s manufacturing sector, which is now the lowest in the developed world. This situation highlights a critical disconnect between Australia’s resource wealth and domestic energy policies, which have failed to leverage these resources to benefit the local economy.

Stagflation and Economic Growth

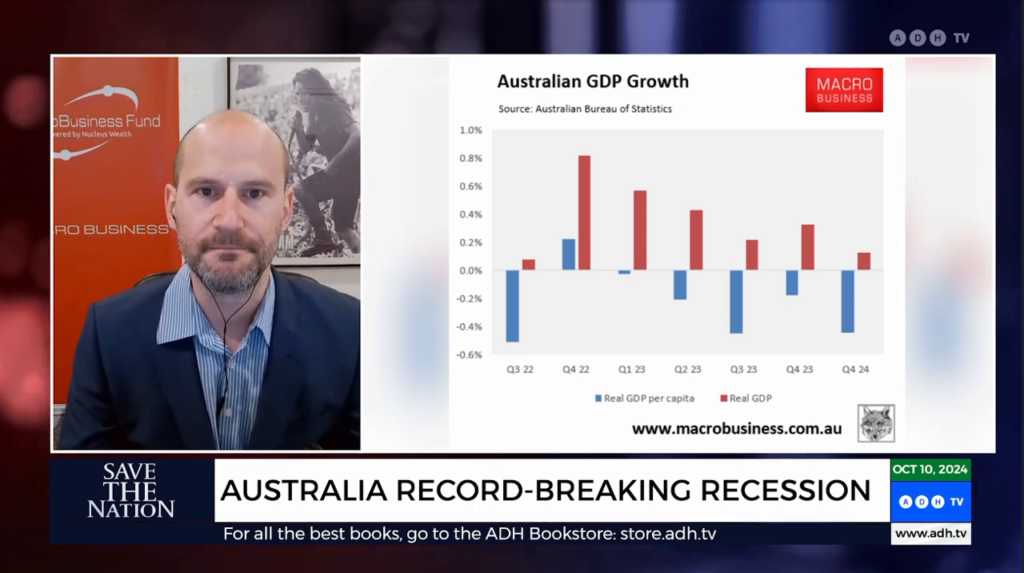

Australia is facing the prospect of decades of stagflation, a period characterized by low economic growth and high inflation. This situation arises from a phenomenon known as “capital shallowing,” where population growth outpaces business investment and infrastructure development. As a result, less capital is available per worker, decreasing productivity.

A practical example of capital shallowing can be seen where a cafe with two workers and one coffee machine can produce fifty coffees. If the number of workers doubles without an additional coffee machine, productivity per worker declines due to congestion and inefficiencies.

Australia’s population has grown by 8.4 million this century, primarily through immigration, but infrastructure and business investment have not kept pace. This has led to a decline in productivity and per capita GDP growth. The chart illustrates that when immigration rates doubled in the mid-2000s, productivity and GDP growth fell, highlighting the capital shallowing issue.

Research from the Bank for International Settlements (BIS) indicates that Australia and Canada suffer from poor productivity due to this effect. The BIS suggests that as long as productivity remains low, Australia will experience sluggish per capita GDP growth and higher inflation than would otherwise occur.

“Australia is likely to experience a period like we had in the early seventies.”

This combination of low growth and high inflation, albeit for different reasons, resembles the economic conditions of the early 1970s and is a classic example of stagflation.

Conclusion and Future Outlook

Reflecting on the discussions, it is evident that Australia’s economic trajectory is at a critical juncture. The comparison to Argentina is a stark warning of the potential decline in living standards if current policies persist. The conversation highlights the risk of Australia slipping in global economic rankings despite its abundant resources.

“It’s a recipe for falling living standards.”

The contrast with Singapore underscores the need for strategic economic reforms. While Singapore thrives with limited natural resources, Australia’s wealth is skewed by inflated property values, which do not equate to genuine economic prosperity.

Looking forward, Australia must reassess its economic strategies. Embracing innovative policies and leveraging its resource wealth could prevent a decline like Argentina’s. The call to action is clear: adopt better economic policies to secure a prosperous future.

Thanks for Reading

Steven Smith

More Stories

Ex-Marine Discusses Afghanistan’s Aftermath and Growing Islamist Threat in Britain

Understanding the Argument: Taxation as Theft

Why Socialism Makes Government Corruption Worse